2022 Software Report

- Kelly J. Thomas

- Jul 8, 2022

- 4 min read

Updated: Jan 6, 2023

The 2022 version of the report (link) includes a number of new elements, including sub-industry analysis.

One Word - Software

In the 1967 movie The Graduate, Mr. McGuire (played by Walter Brooke), a friend of the Braddock family, gives recent college graduate Benjamin Braddock (played by Dustin Hoffman) career advice in the form of one word – “Plastics.” In other words, there was a great future in plastics. Today plastics are part of just about everything in the physical world (It’s also unfortunate that plastics are part of everything in our environment. By some counts there are five trillion pieces of plastic in our oceans and the amount being removed continues to significantly lag the amount being put in every year).

If The Graduate were made today, Mr. McGuire’s career advice could be summed up in one word – “Software.” There is no question that software is a critical element of the future of just about everything.

Valuation Declines

That said, the headline story for software companies this year has been steep valuation declines, as we point out in the 2022 version of the Worldlocity Software Report, which was published in May.

But if you look beyond the past two years, valuations are simply returning to historical norms from breathtaking levels of 2020 and 2021. The declines look frightening only because of the heights from which they started. Absolute valuations have simply reverted to the more historical norms of the mid 2010s, as shown in Figure 1 below. Furthermore, the average valuations of 2020 and 2021 coincided with a flurry of IPOs. There were almost as many software IPOs in 2020 and 2021 as in the entire previous decade, which was a very robust decade for software.

Figure 1 - Average and Median Market Cap Multiples for Software Companies (n=250+)

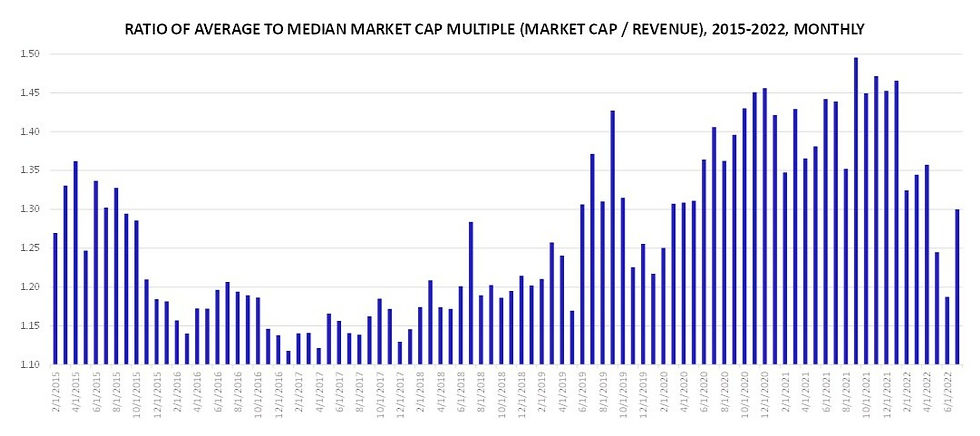

A key part of average valuation declines is even larger declines in the top quartile performers. In other words, the companies with the highest multiples and the largest multiple increases in 2020 and 2021 have seen the largest declines. This can be seen clearly in the decline in the ratio of the average to the median, as shown in Figure 2. The closer the average is to the median, the fewer the outliers.

Figure 2 - Ratio of Average to Median Market Cap Multiple

The period starting in 2022 may be one of consolidation, slowing capital market investment, and reduced IPO activity. But there is every reason to be long software. The race is a marathon, and the market has been sprinting for the past two years. It is natural that we would experience a respite in which the market seeks a new water mark that is closer to historical levels.

Some are comparing this market to the early 2000s after the bursting of the Internet bubble. But that was a completely different market, and really in the very early stages of the packaged software business. It furthermore predated the subscription and SaaS cloud models as we know them today. In fact, a lot of the consolidation activity at that time was aimed at securing recurring maintenance streams, the service of which is now part of SaaS subscriptions.

We have moved significantly beyond Nicholas Carr’s 2005 Sloan Management Revenue article titled “End of Corporate Computing.” This article was prescient with respect to movement towards a centralized computing utility but less so in saying there would be a reduction in computing diversity within and across companies, making computing a non-differentiating utility like electricity.

In fact, since the early 2010s, there has been a proliferation of all sorts of basic elements of computing infrastructure, including database, communication, network, security, data pipelines, and data processing. Furthermore, application diversity continues to grow. Companies may no longer be hosting their own infrastructure and applications, but they are subscribing to dozens of infrastructure services and applications to run their businesses. And each company is using these services slightly differently to support differentiated business processes. Furthermore, custom development and integration continue to represent large segments of the overall information technology market, as evidenced by the IT services industry, which represents hundreds of billions of dollars of revenue.

2022 Software Report

The 2022 version of the Worldlocity Software Report was published in May. This version of the report has been expanded to include more than 250 public companies, with much more global diversity (note: since being published in May, three of the companies have been taken private; these will not be included in future reports; at the same time, others will be added).

The size of the data set now also provides for sub-industry views. The report provides segmentation of the market into two domains – infrastructure and applications – along with fifteen sub-markets, as shown in Figure 3. The report includes detailed descriptions of the types of companies that fall into each of the sub-markets.

All software companies are assigned to one sub-market. This is also an indication of the rapid expansion and growing maturity of the industry. Of course, the opposite – or consolidation – is also true, as conglomerates seek to dominate large segments of the market through mergers and acquisitions (these large players may be partitioned into their own segment in future reports).

Figure 3 - Software Industry Markets

Downloading the software report now requires you to enter your name and email. This is the start of a process to keep you updated and allow for automatic distribution of future reports. We hope you find something in the report that is useful for your work in the software industry. Please email questions and suggestions to info@worldlocity.com.

Comments